What Cranston AI users actually want

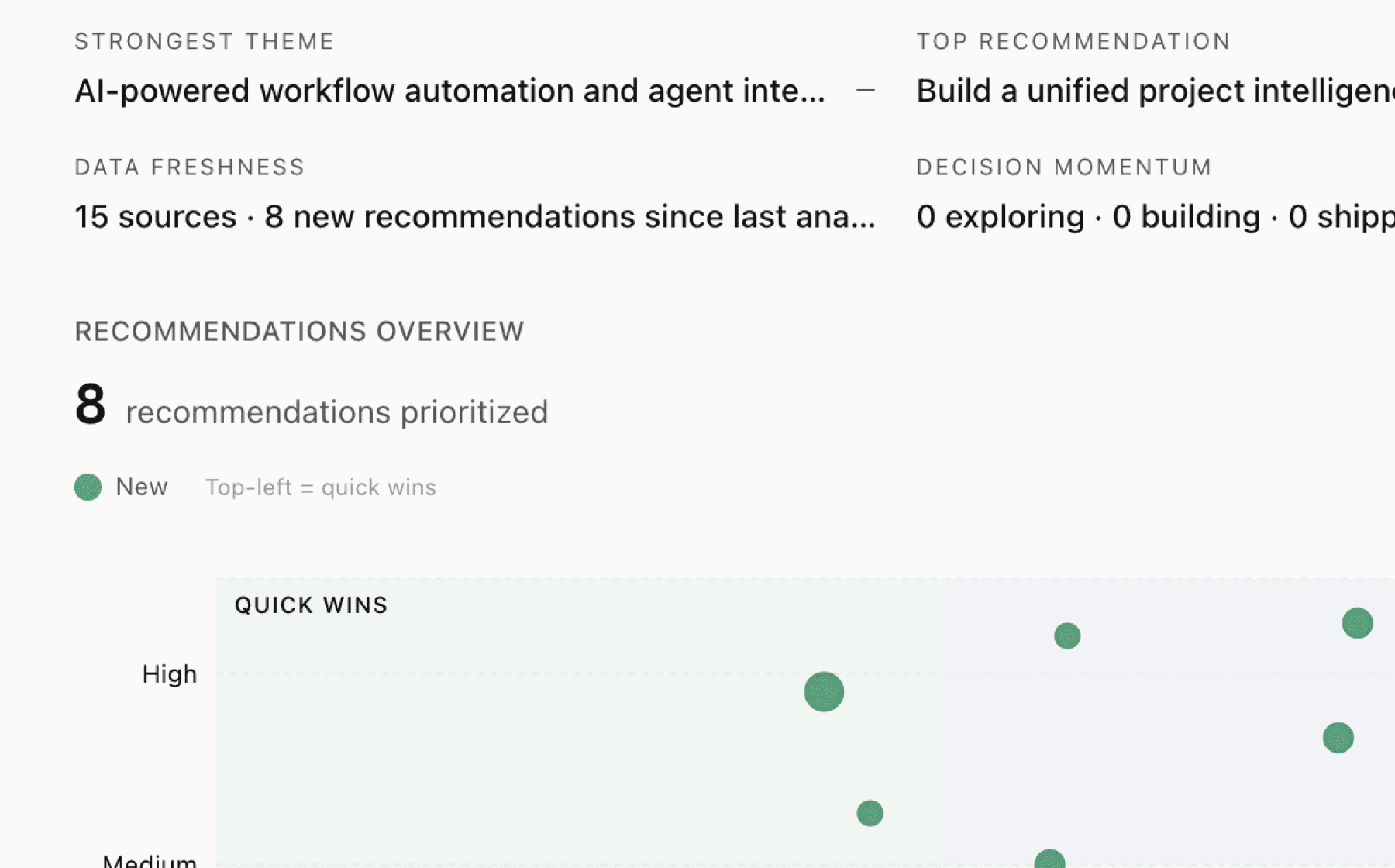

Mimir analyzed 5 public sources — app reviews, Reddit threads, forum posts — and surfaced 15 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build a transparent AI confidence scoring system that shows users exactly where human review is needed

High impact · Medium effort

Rationale

The data reveals a critical tension in the product's value proposition. Users get 99.8% transaction matching accuracy but are told they must manually verify everything because AI accuracy isn't guaranteed at 100%. This creates confusion about when to trust the system and wastes the time savings that attracted users in the first place.

The evidence shows users switched to save 70% on costs and get setup done in 30 minutes instead of weeks, but then they're asked to review 1,247 transactions manually. That's not automation, that's auditing. The licensed CPA review at month-end is valuable, but users need guidance during the month.

Implement a confidence score on every transaction, expense categorization, and financial insight. Show green checkmarks for high-confidence items, yellow warnings for medium confidence, and red flags for low confidence or anomalies. Let users filter to review only flagged items. This maintains accuracy while delivering the time savings users expect. It also creates a feedback loop where user corrections improve the model's confidence calibration over time.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

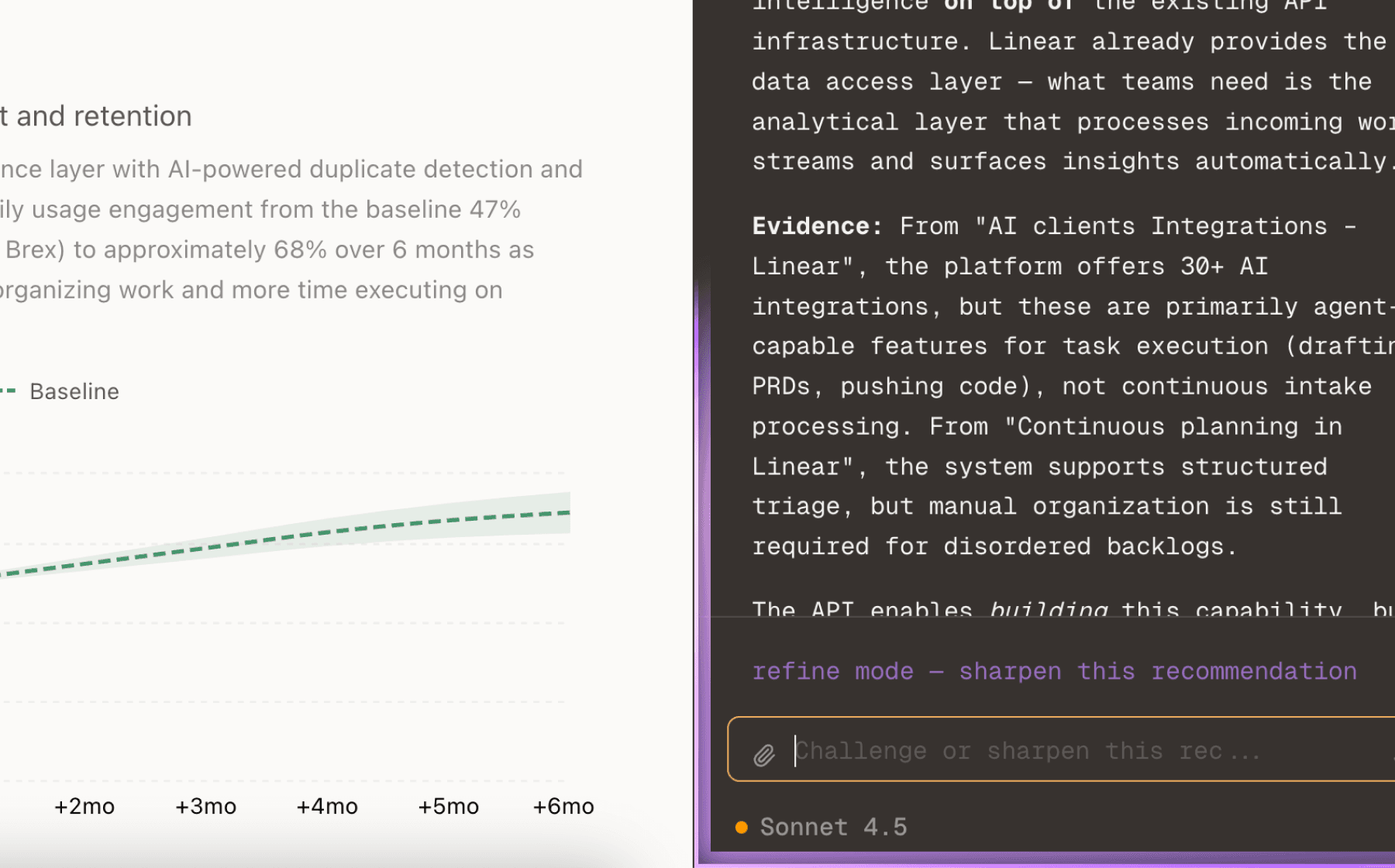

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

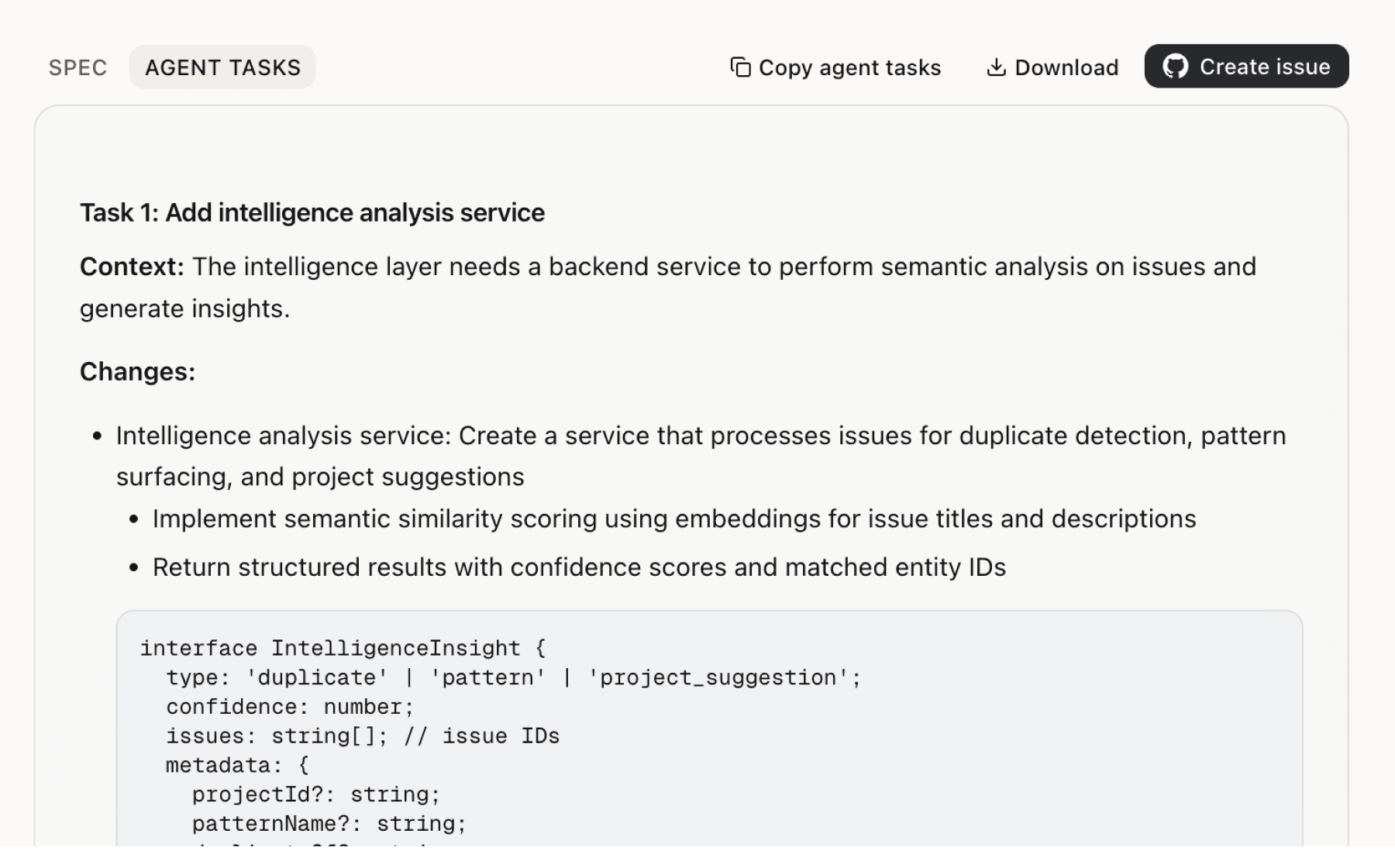

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

Users are getting real-time P&L and cash flow visibility, but the evidence shows the AI's potential goes far beyond displaying numbers. The product claims the AI understands business context and learns from patterns to provide actionable insights, not just categorization. Right now users see data but must interpret it themselves.

The current 30-day data retrieval window after termination creates unnecessary anxiety for users considering the product or planning to leave. When switching from a traditional firm costs 2-4 weeks, users need confidence they can exit cleanly if needed. The non-refundable fees and limited export window signal lock-in, which contradicts the transparent pricing and no-contracts positioning.

New users face a credibility gap in the first 30 minutes of setup. They're asked to connect all their financial accounts and trust an AI to handle their books immediately, but they have no evidence the system works for businesses like theirs. The 99.8% accuracy and 70% cost savings are compelling, but they come from testimonials, not the user's own experience.

The product positions itself as empowering accountants to focus on strategy instead of data entry, but the current workflow doesn't facilitate that delegation. When the CPA reviews month-end and finds discrepancies, they need a way to route specific questions back to the founder or operations team with full context about what needs clarification and why.

Users are handing over comprehensive financial data, transaction details, and bank account access to a startup, but the privacy policy acknowledges no storage method is 100% secure and data gets processed internationally. That's honest but unsettling without context about what protections are actually in place.

The 70% cost reduction is the product's most compelling metric, but it's currently just a testimonial. Users considering the switch from a $1,500/month bookkeeper or a traditional firm with hidden fees need to see their specific savings projection before committing to migration.

Insights

Themes and patterns synthesized from customer feedback

Cranston AI's founding team combines Sean O'Bannon's 10+ years building AI and financial automation systems (Stanford, Databricks, ReMatter) with Max Minsker's accounting firm operations and 10+ years scaling finance at tech companies. This pairing of AI engineering and accounting domain expertise directly addresses the product's core challenges.

“Sean O'Bannon has 10+ years building AI systems and financial automation tools at Stanford, Databricks, ReMatter”

Cranston AI's terms include non-refundable tax filing fees once work has commenced, no partial-month refunds, and 30-day data retention after account termination before potential deletion. These policies may create customer friction in churn scenarios or urgent data retrieval needs.

“Tax filing fees are non-refundable once work has commenced; monthly subscriptions have no partial-month refunds”

Cranston AI explicitly states that AI automation does not constitute professional financial, tax, or legal advice and users must consult qualified professionals separately. This legal positioning protects the company but creates potential friction for users seeking complete accounting solutions.

“Service does not constitute professional financial, tax, or legal advice; users must consult qualified professionals separately”

Cranston AI commits to 99.9% uptime but explicitly does not guarantee uninterrupted or error-free service. This standard SaaS availability commitment may create gaps for businesses with higher reliability requirements.

“Company commits to 99.9% uptime but does not guarantee uninterrupted or error-free service”

Cranston AI is backed by Y Combinator, a top-tier accelerator, which provides both market validation and access to investor and founder networks valuable for scaling a fintech product.

“Company backed by Y Combinator, a top-tier accelerator”

The market pain point of manual bookkeeping limiting business access to intelligent accounting automation persists across industries, driving demand for AI-powered solutions that handle routine work automatically and intelligently.

“Manual bookkeeping is inefficient and limits business access to intelligent, automated accounting solutions”

Cranston AI processes data internationally with different data protection standards and implements GDPR and CCPA compliance mechanisms (data access, deletion, portability, opt-out rights). Users in regulated jurisdictions have formal data rights, but international transfer and processing create ongoing compliance management burden.

“California residents have CCPA rights including right to know what data is collected, request deletion, and opt-out of data sales”

Cranston AI collects comprehensive financial data, transaction details, and usage analytics to deliver AI-driven services, with explicit acknowledgment that no storage method is 100% secure. While data is not sold to third parties and users have data rights under GDPR/CCPA, users implicitly accept security and privacy risks inherent to cloud-based financial data processing.

“Cranston AI collects comprehensive financial and business data including account info, billing details, financial transactions, and accounting data to provide services”

Cranston AI's positioning emphasizes that its AI understands business context and learns from transaction patterns to provide actionable insights, not just mechanical categorization. This reflects a strategic direction toward more intelligent financial analysis and decision support.

“AI should understand business context, learn from transaction patterns, and provide actionable financial insights beyond simple categorization”

Cranston AI's positioning emphasizes augmenting accountants rather than replacing them, freeing them from data entry to focus on strategy and higher-value advisory work. This framing positions the product as enabling professional accountants to work more effectively.

“Product positioning emphasizes empowering accountants with strategy-focused work rather than replacing them”

Cranston AI provides real-time dashboards showing P&L, cash flow, runway, burn rate, and AR aging without waiting for accountant reports, contrasting with traditional firms' limited availability and delayed reporting. This 24/7 access to financial data is positioned as a key competitive advantage.

“Real-time financial dashboards provide visibility to P&L, cash flow, runway, burn rate, AR aging without waiting for accountant reports”

Cranston AI implements SOC 2 Type II certification, AICPA compliance, AES-256 encryption, and point-in-time backup restore, establishing trust with users managing sensitive financial data. Security is a table-stakes feature rather than a premium add-on.

“Security: SOC 2 Type II certified, AICPA compliant, AES-256 bank-level encryption, point-in-time backup restore”

Cranston AI's core value proposition is automating repetitive bookkeeping tasks that traditionally required hours of manual work or expensive bookkeeper hiring. Users report 70% cost reductions (from $1,500/month to $500/month) and setup in 30 minutes versus 2-4 weeks with traditional firms, with AI handling transaction categorization, reconciliation, and invoice processing.

“AI agents handle repetitive transaction categorization and reconciliation work that previously required hours of manual bookkeeper effort”

Cranston AI uses a single flat-rate pricing model with all features included (unlimited team members, integrations, tax prep, mobile app, support) rather than tiered pricing or upsells, with a free trial and no setup fees. This contrasts sharply with traditional accounting firms' hourly billing and hidden fees.

“No feature tiers or upsells - all features included in single pricing model (AI automation, real-time reports, unlimited connections, expert support, mobile app, security, unlimited team members, tax...)”

Cranston AI demonstrates strong transaction matching accuracy (1,245 of 1,247 transactions matched in sample workflow) and employs licensed CPAs to review month-end closes, ensuring professional oversight alongside automation. However, AI accuracy is not guaranteed at 100% and users must manually verify all categorizations.

“Monthly reconciliation workflow: 1,247 transactions imported, 1,245 matched, 2 discrepancies identified and flagged for review”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.