What Infinite users actually want

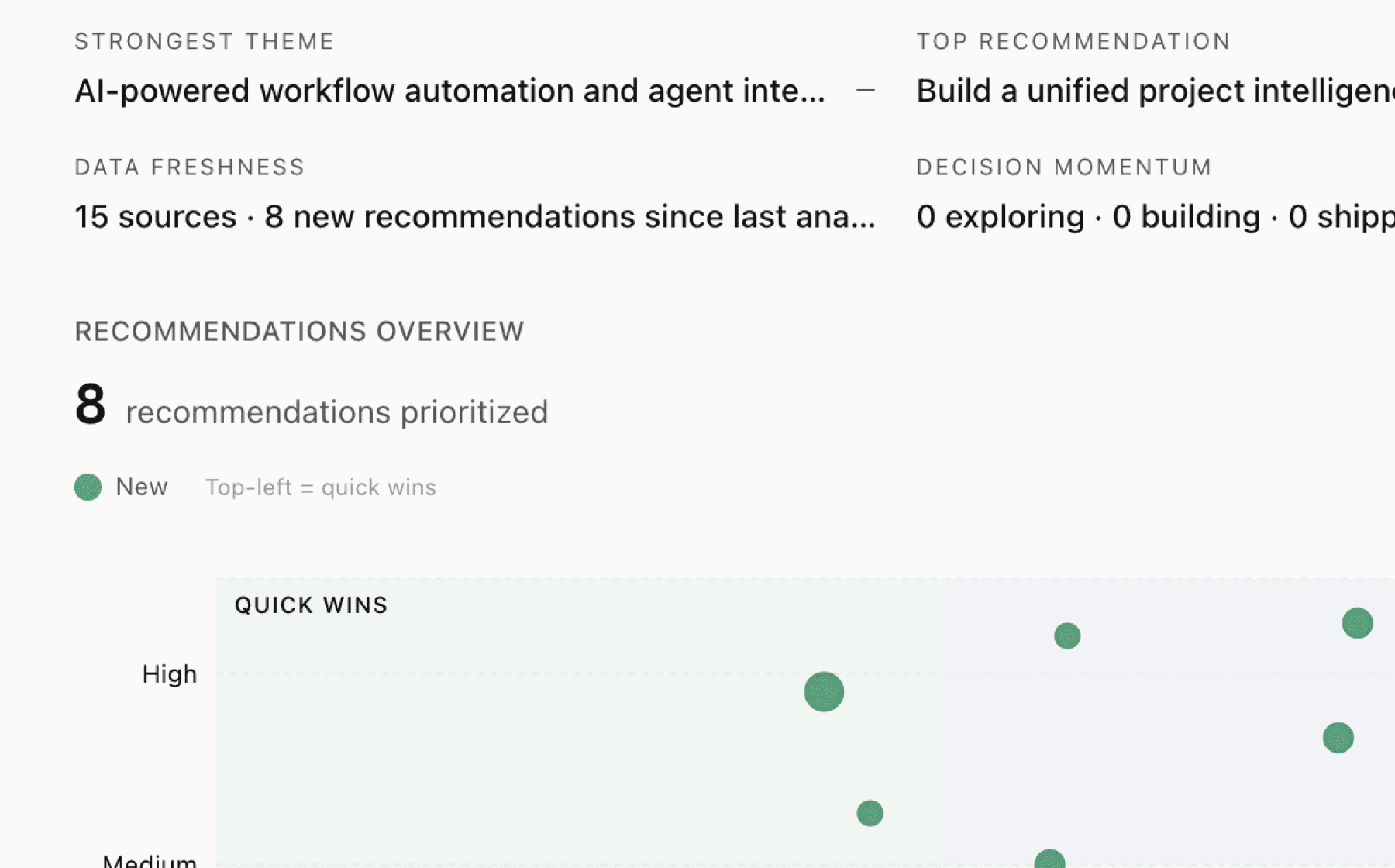

Mimir analyzed 12 public sources — app reviews, Reddit threads, forum posts — and surfaced 14 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build enterprise admin controls for organizational governance and audit trails

High impact · Medium effort

Rationale

Admin users can currently modify critical account settings without sufficient constraints, and Infinite reserves broad unilateral rights to cancel orders or revoke licenses. This creates governance uncertainty for enterprise customers who need predictable access controls and change management.

For a B2B stablecoin processor targeting customers with $1M to $1B+ annual volumes across financial verticals, organizational control gaps represent a direct barrier to enterprise adoption. Large organizations require role-based access controls, approval workflows for sensitive changes, and audit logs to meet internal security and compliance requirements.

Implementing granular permission systems with change approval workflows, immutable audit trails, and configurable admin hierarchies would reduce friction in enterprise sales cycles and increase retention by addressing a core governance need. This work complements the existing compliance infrastructure by extending control and transparency to the account management layer.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

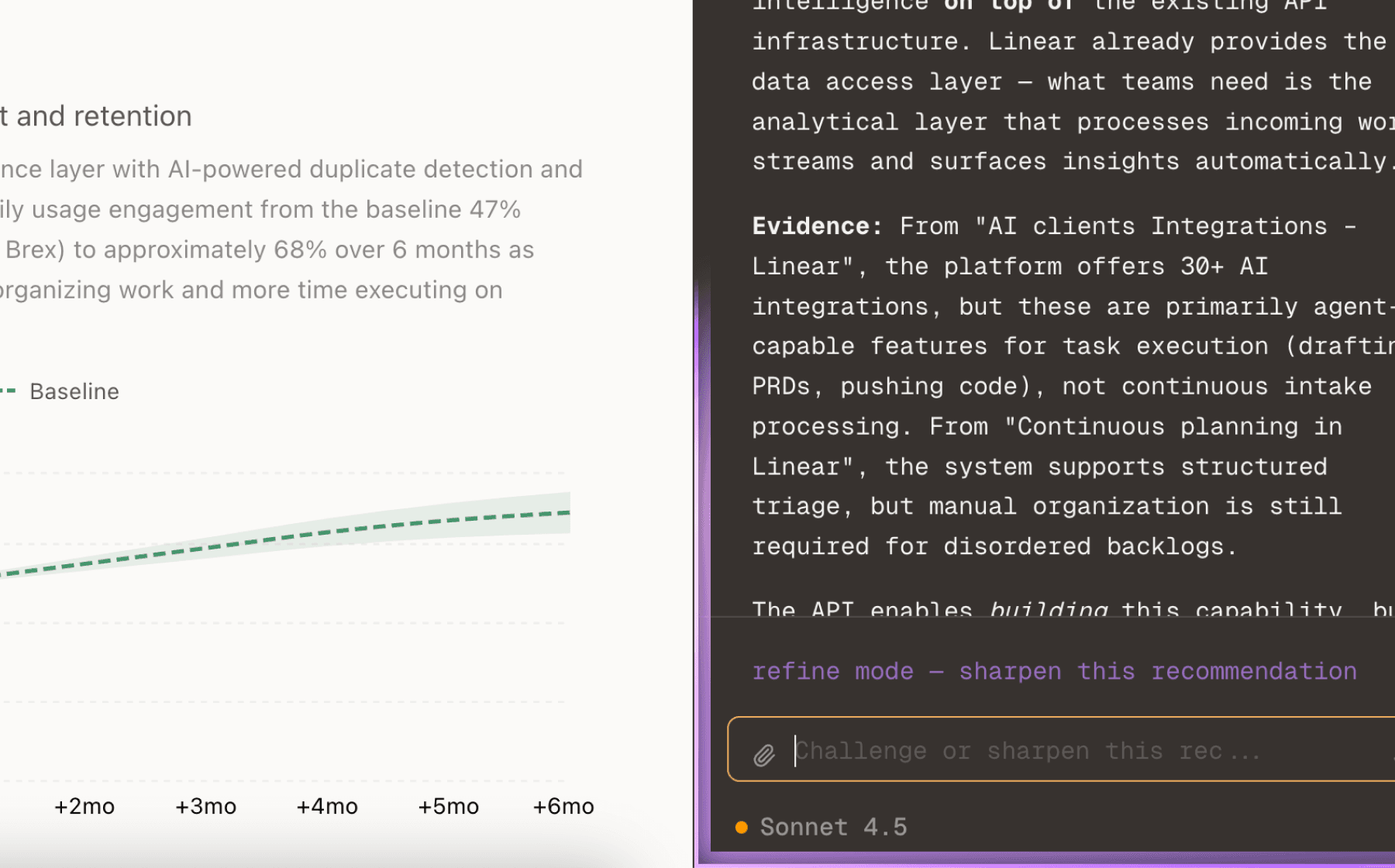

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

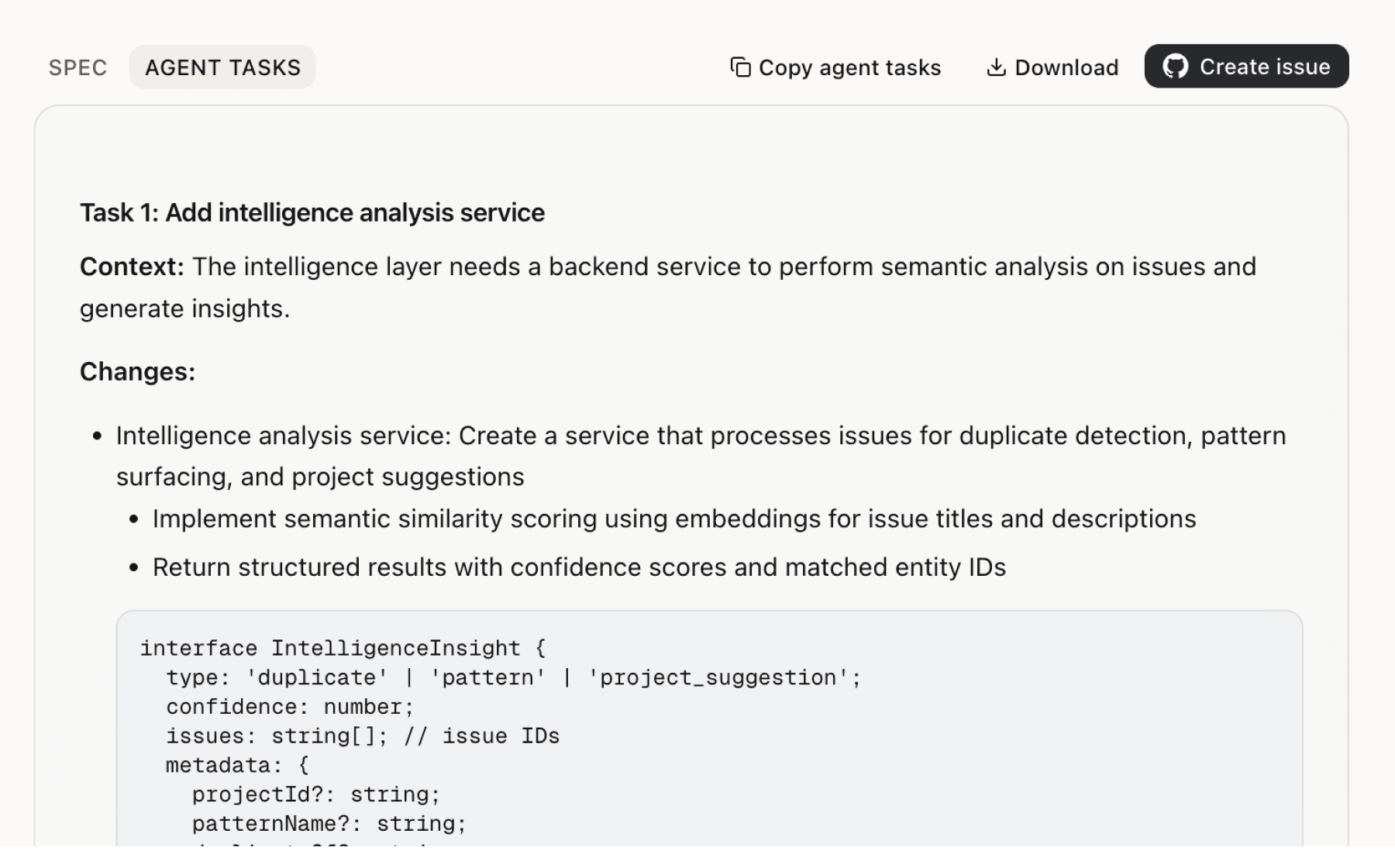

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

The platform collects detailed behavioral data through third-party technologies and shares personal data with advertisers and partners for marketing and AI/ML model training. This creates regulatory compliance concerns for enterprise users who must manage data processor relationships and demonstrate GDPR, CCPA, and financial services compliance to their own customers and regulators.

The platform positions turnkey APIs and SDKs as core differentiators enabling deployment in days rather than weeks, but developer-first integration requires more than API documentation. Developers need hands-on environments where they can test compliance scenarios, simulate cross-border settlements, and validate integration patterns before committing engineering resources.

The platform supports same-day settlement to 170+ countries, but coverage alone doesn't guarantee product-market fit in every corridor. Different regions have dominant local payment methods and banking infrastructures that determine whether businesses can actually deploy stablecoin rails for their use case.

Compliance is architected as a fundamental platform layer with real-time fraud detection, risk scoring, and anomaly detection, but these capabilities are currently embedded in payment flows rather than exposed as standalone tools for customer operations teams. Enterprise customers need visibility into compliance decisions and the ability to investigate flagged transactions without contacting support.

Infinite reserves the right to cancel or reverse purchase orders per financial partner requirements, but the terms don't describe how customers are notified or how they can manage the impact on their own users. For a B2B platform processing high-volume payments, unilateral reversals without clear procedures create operational risk for customers.

The platform must maintain high availability and zero downtime across event-driven ledgering, compliance, and risk infrastructure, but there's no evidence of customer-facing observability or transparency around system health. Enterprise customers need visibility into platform reliability to build trust and plan their own operations.

Insights

Themes and patterns synthesized from customer feedback

The product is positioned to serve a broad market from $1M to $1B+ annual volume customers, indicating a scaled go-to-market strategy targeting diverse enterprise payment verticals and geographies.

“Infinite is used by industry leaders including Coinbase, Codex, Sardine, dYdX, Chainlink, and Conduit”

The team brings deep experience from scaling global payments companies (Coinbase, dYdX, Chainlink) and compliance expertise (Socure, Sardine), establishing credibility and operational know-how with enterprise customers in payments and regulatory environments.

“Team has deep experience scaling global payments companies and has worked with industry leaders including Coinbase, dYdX, Chainlink, and others”

Primary engagement conversion mechanism for prospective customers is a 30-minute demo, indicating that user acquisition and retention depend heavily on demo experience quality and sales funnel optimization.

“30-minute demo is the primary engagement mechanism for prospective customers”

Company operates with in-person collaboration in San Francisco, emphasizing integrity, transparency, and efficient execution as core cultural values. This model shapes decision-making speed and team cohesion.

“Fast-paced, high-ownership environment with in-person collaboration in San Francisco location specified”

Terms include mandatory individual arbitration, class action waivers, and explicit liability disclaimers for user disputes, potentially limiting user recourse and creating transparency gaps around platform accountability.

“Mandatory individual arbitration and class action waiver provisions included in Terms (Sections 15.2 and 15.3)”

The platform collects detailed behavioral data (mouse movements, clicks, keystrokes) through third-party technologies and shares personal data with advertisers and partners for marketing and AI/ML model training. This creates potential privacy and regulatory compliance concerns for enterprise users.

“Company collects contact, professional, account, payment, security, event, and feedback information directly from users.”

Terms of Service reveal friction in organizational access controls, where admin users can modify critical settings without sufficient constraints, and Infinite reserves broad unilateral rights to cancel orders, reverse transactions, or revoke licenses. These gaps create governance and trust uncertainty for enterprise customers.

“Org Users with admin-level access can modify account settings, access, and billing information; Infinite disclaims liability for such changes”

The system must maintain high availability and zero downtime across event-driven ledgering, compliance, and risk infrastructure while scaling with transaction volume. This is a foundational engineering requirement for retention and reliability.

“Need for highly available, event-driven systems for ledgering, compliance, and risk that scale with transaction volume while maintaining zero downtime”

Platform functionality depends on seamless integration with banking, payments, and compliance providers, as well as strategic partnerships like Tempo ecosystem to expand infrastructure reach. This ecosystem orchestration is critical to delivering the full value proposition.

“Integration with banking, payments, and compliance providers is core to platform functionality”

Users need unified visibility across identity verification, case management, and customer lifecycle tracking to effectively manage compliance workflows and customer interactions. This capability enhances engagement by enabling operational efficiency.

“Unified customer 360° view for managing customer lifecycles from identity verification to case management”

Engineering and product teams must maintain direct customer collaboration and fast feedback loops to keep the roadmap aligned with real user needs and preserve competitive advantage. This operational cadence is essential for retention in a fast-moving market.

“Direct customer embedding and rapid iteration emphasized as critical to ensure roadmap aligns with user needs”

Compliance (KYC, AML, fraud detection, automated reporting) is architected as a fundamental platform layer rather than a bolt-on feature, with dedicated compliance leadership and real-time anomaly detection built into all products. This positioning directly addresses stablecoin adoption barriers by removing complexity and enabling businesses to operate across multiple jurisdictions.

“Infinite provides stablecoin payments with turnkey orchestration for global businesses, enabling compliance through embedded KYC, AML, and business verification”

The product centers on turnkey APIs, SDKs, and orchestration that enable developers to deploy global stablecoin payments and compliance in days rather than weeks or months. This directly reduces integration friction and is positioned as a core engagement differentiator.

“Infinite provides stablecoin payments with turnkey orchestration for global businesses, enabling compliance through embedded KYC, AML, and business verification”

Instant, same-day settlement to 170+ countries through seamless connections to local banking networks and on/off-ramps removes traditional pain points around slow settlement, high fees, and complexity. This capability underpins the core value proposition for multinational enterprise customers.

“Seamless connections to local banking networks for instant local settlement across multiple countries and currencies”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.