What Mage Legal users actually want

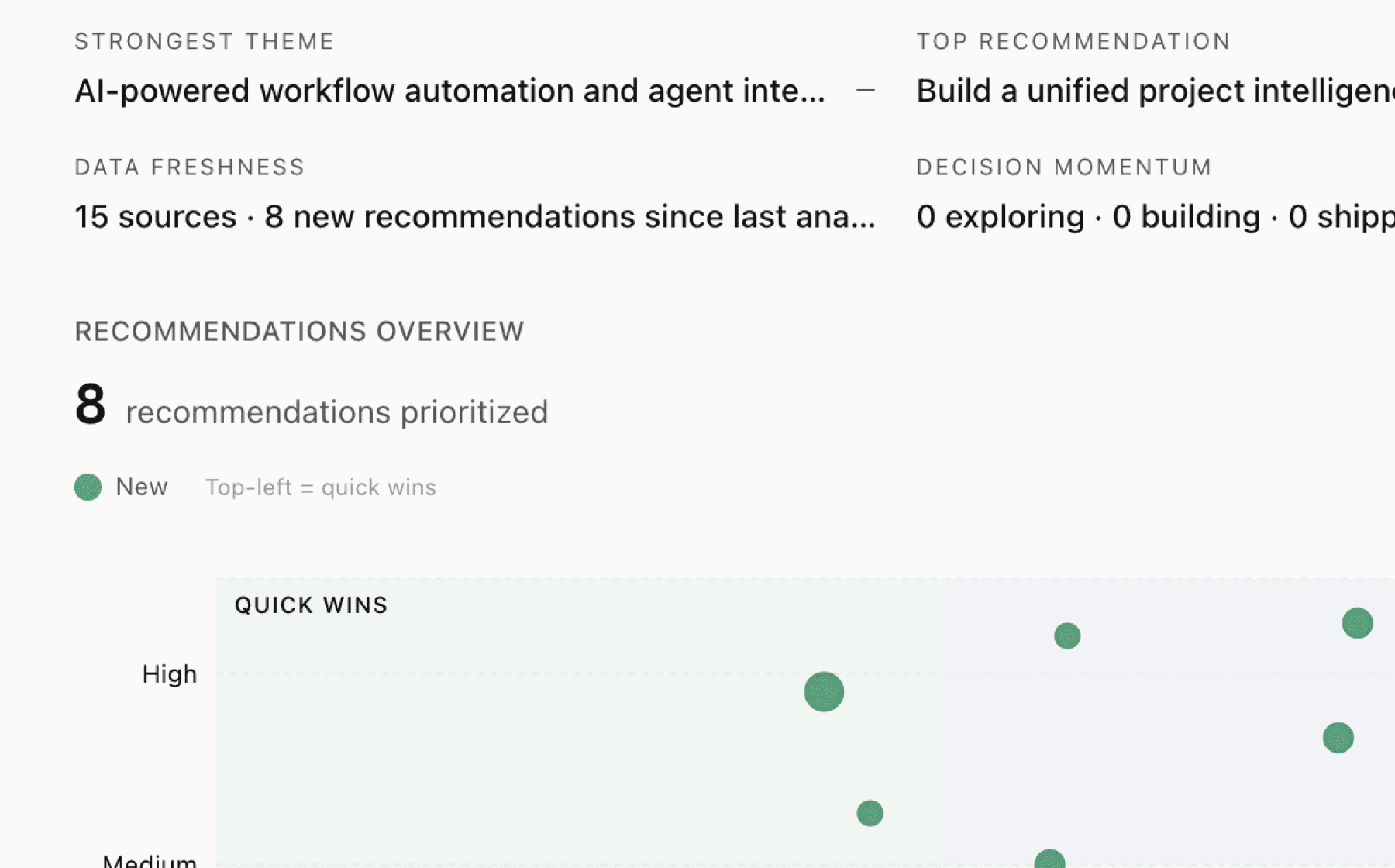

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 16 patterns with 8 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build an integrated change of control consent workflow with deal structure scenario modeling

High impact · Large effort

Rationale

Change of control provisions are the number one deal risk in M&A transactions. The evidence shows counterparties can kill deals entirely by refusing consent, landlords use COC clauses to reset below-market rent, and debt documents trigger automatic defaults requiring immediate loan repayment. Attorneys currently must manually identify these provisions across hundreds of documents and then map how different deal structures trigger them.

Mage already auto-detects COC clauses and tracks consent requirements, but the platform needs a dedicated workflow that combines detection with strategic modeling. This means showing attorneys which consents are triggered under different deal structures (reverse triangular merger vs asset purchase), categorizing consents by materiality (deal-critical vs routine), and providing a tracking interface to monitor consent status through closing. The gap between detection and action is costing users millions in consent fees and failed deals.

This recommendation addresses the full lifecycle of COC risk management from identification through closing. It transforms raw clause extraction into strategic intelligence that informs deal structure negotiations and prevents consent-related deal failures.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

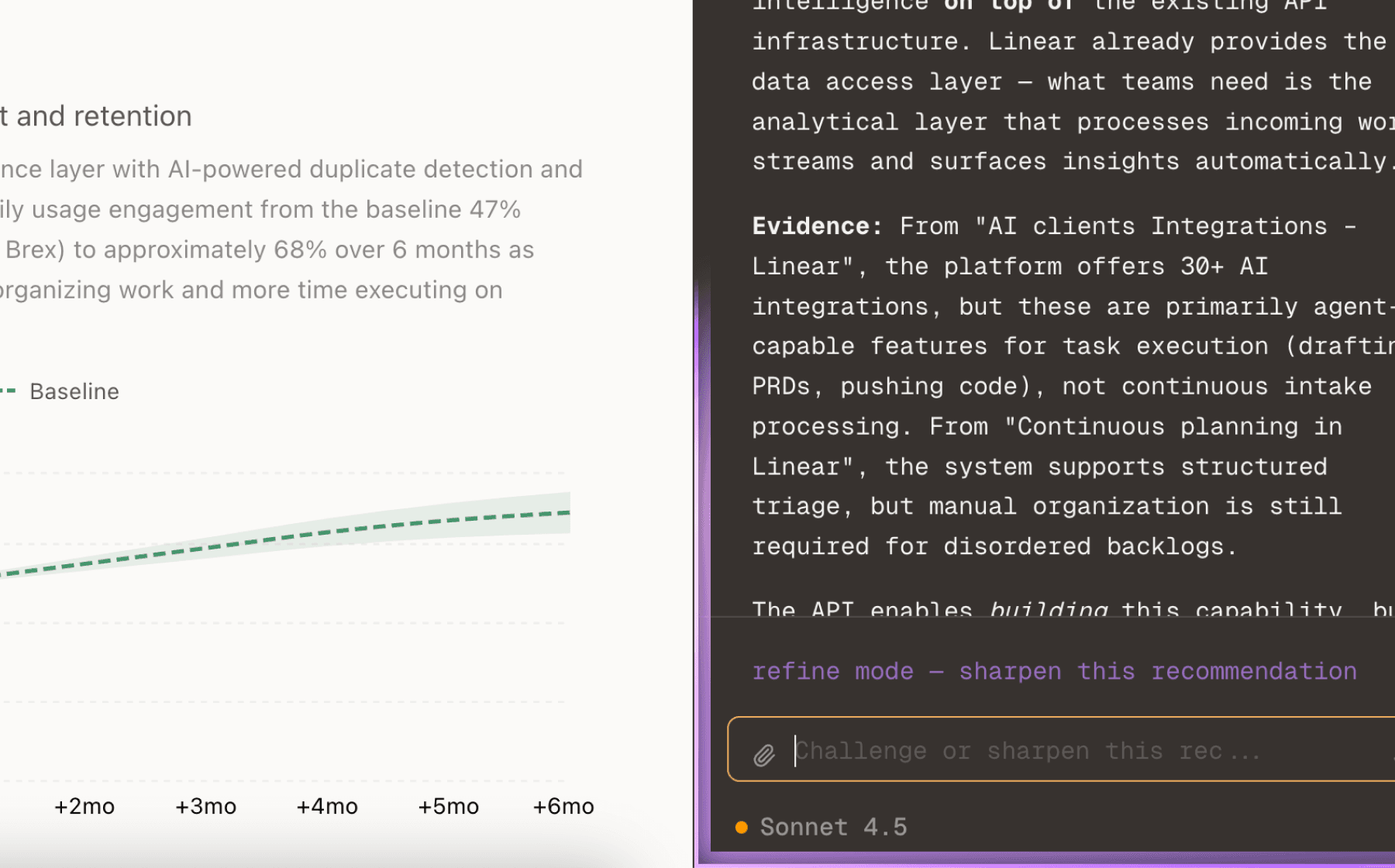

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

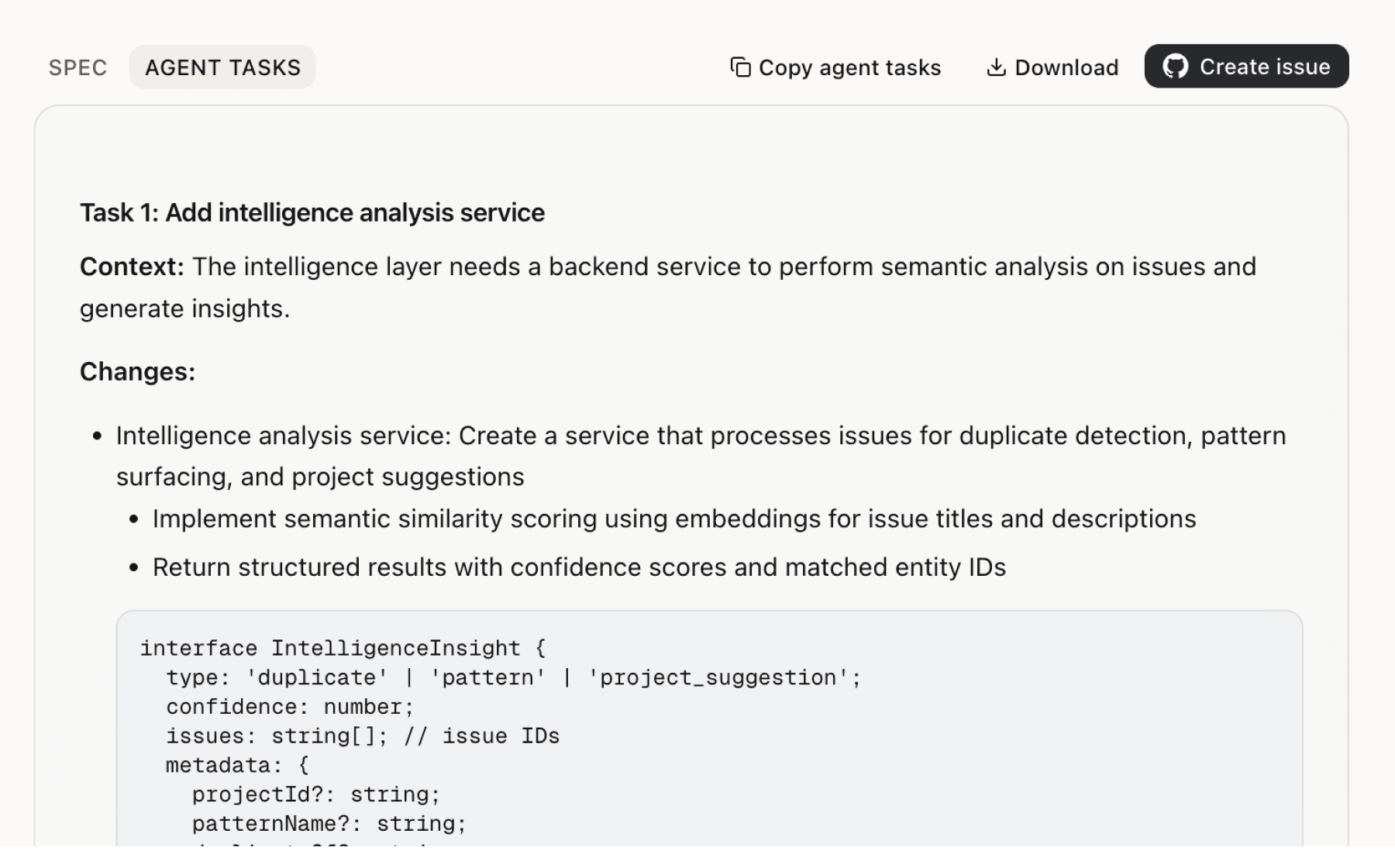

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

7 additional recommendations generated from the same analysis

IP due diligence is forensic work where unresolved ownership gaps can destroy entire transactions. The evidence shows contractors retain IP ownership unless written assignments exist, GPL-licensed code can taint entire products making them unsellable, and breaks in chain of title mean buyers cannot prove ownership rights. When Cisco acquired Linksys for $500M, they discovered GPL code violations. When VW bought Rolls-Royce factories for $790M, they owned the facility but had no right to use the brand name.

Disclosure schedules are where diligence findings become legal commitments. The evidence shows that if an item is not on the schedule, it is not disclosed, and buyers can sue for breach even if they already knew about the issue during diligence. Section numbers in disclosure schedules correspond directly to purchase agreement sections, yet attorneys manually map hundreds of findings to the correct sections while avoiding both under-disclosure and kitchen-sinking.

Indemnification provisions are the backbone of post-closing risk allocation, yet the evidence shows attorneys struggle with complex mechanics like double materiality traps where reps qualified by material AND mini-baskets create two hurdles to recovery. Market standard caps with rep and warranty insurance range from 0.5 to 1 percent of enterprise value, but without RWI they jump to 10 to 20 percent. These provisions determine who pays when things go wrong after closing.

AI hallucination is not a theoretical risk in legal diligence. The evidence shows AI models fabricate plausible-sounding court cases, citations, and statutes that do not exist. More dangerously, AI may hallucinate benign clauses that do not exist, leading lawyers to incorrectly believe risky contracts are safe. In M&A transactions where millions of dollars turn on the presence or absence of specific provisions, hallucinated findings create catastrophic risk.

The pre-closing phase is the most critical period for risk management in M&A transactions. The evidence shows attorneys must track regulatory approvals like HSR filings with 30-day waiting periods, CFIUS reviews, third-party consents, conditions precedent, and closing deliverables. Bring-down certificates bridge signing and closing by certifying that representations and warranties remain true at the closing date. Missing a single condition precedent can delay closing or give buyers grounds to walk away.

High-stakes M&A negotiations involve dozens of contract versions exchanged between parties. The evidence shows missing clauses or silent deletions can lead to millions in liability, and attorneys spend hours manually comparing versions to identify material changes versus formatting tweaks. Mage already offers multiple view modes for redline review and categorizes changes into material versus non-material, but the platform needs to enhance this with intelligent materiality detection.

Data rooms in M&A deals contain hundreds to thousands of documents with inconsistent naming conventions. The evidence shows generic file names like Scan001.pdf become unsearchable once files leave folder structure context, unprocessed scanned PDFs without OCR force attorneys to manually read every page doubling review time, and attorneys need to find provisions like change of control clauses instantly across all documents. Well-organized data rooms reduce legal costs, but even the best organization cannot solve search when documents are poorly named or scanned without OCR.

Insights

Themes and patterns synthesized from customer feedback

Feature request for natural language Q&A capability enables users to ask questions like 'Do any supplier contracts expire before 2026?' or 'List all contracts with MFN clauses' across entire data rooms. This advanced search capability would improve accessibility and reduce time spent manually searching for specific contract provisions.

“AI should enable natural language Q&A on data rooms (e.g., 'Do any supplier contracts expire before 2026?' or 'List all contracts with MFN clauses').”

Employment Agreement Review analyzes severance triggers, equity acceleration, non-competes, and retention terms as important components of overall deal diligence. Platform supports comprehensive review of employment-related contingent liabilities that impact deal valuation and integration planning.

“Employment Agreement Review analyzes severance triggers, equity acceleration, non-competes, and retention terms”

Data room structure should mirror Purchase Agreement Representations & Warranties sections for clear mapping. Users need granular role-based access control, structured naming conventions, OCR on scanned PDFs, and AI-powered intelligent search across documents regardless of naming to instantly find provisions. Well-organized data rooms reduce review time, costs, leak risk, and unsearchable generic file names.

“Pre-closing phase is identified as the most critical period for risk management in M&A transactions, requiring tracking of regulatory approvals, third-party consents, conditions precedent, and...”

Fast onboarding, intuitive dashboard with real-time progress tracking, email templates with dynamic fields, and multiple report export formats (Excel, Kirkland, PDF) integrate with existing firm workflows. Platform directly reduces time attorneys spend on administrative tasks and document formatting while maintaining institutional memory through deal profile configuration and clause preferences.

“Attorneys focus on judgment calls, client advice, and deal strategy rather than document extraction. This allows firms to handle more deals with existing teams and deliver faster turnaround.”

Pre-closing phase requires tracking regulatory approvals (HSR, CFIUS), third-party consents, conditions precedent, and closing deliverables. Platform supports bring-down certificates, closing checklists with version history, and audit trails to bridge signing-to-closing gaps and prevent condition precedent oversights that maintain negotiation momentum.

“Pre-closing phase is identified as the most critical period for risk management in M&A transactions, requiring tracking of regulatory approvals, third-party consents, conditions precedent, and...”

Multiple view modes (Unified, Changes Only, Side-by-Side) enable different redline analysis tasks with accurate tracking of material vs. non-material changes across contract versions. Platform uses strict file naming conventions and change tracking to prevent errors from missing clauses or silent deletions that could lead to millions in liability.

“Product offers multiple view modes (Unified, Changes Only, Side-by-Side) for contract redline review tailored to different analysis tasks”

Mage connects legal findings to commercial outcomes, EBITDA impact, integration complexity, and reputational risk. AI generates executive summaries and business-translated insights with traffic light risk categorization (Critical/Material/Low) based on business impact rather than legal compliance alone, enabling deal strategy and stakeholder communication.

“Traffic light risk categorization system ranks findings by business impact (Critical/Material/Low) rather than legal compliance alone”

Platform identifies high-risk issues including landlord consent failures for commercial real estate, missing provisions, unusual terms, and issues requiring special indemnities. Detection prevents closing delays and unexpected post-close liabilities by flagging non-standard terms and complex relationships that require attorney attention.

“Mage flags missing provisions, unusual terms, and potential issues requiring special indemnities”

Questionnaire feature tracks unanswered due diligence questions and auto-generates follow-up emails to opposing counsel for missing items. Feature requests include automated weekly diligence status updates with key metrics and findings, enabling systematic tracking of outstanding diligence items throughout deal progression.

“Questionnaire feature tracks unanswered due diligence questions and auto-generates follow-up emails to opposing counsel for missing items”

Mage's six primary products (Tabular, Memo, Redline, Questionnaire, Schedules, Capital Markets) and 30+ supporting modules automate M&A legal diligence across hundreds of documents in minutes rather than weeks. The platform processes 100-500 documents in 10 minutes with tabular grid views and automated extraction that surface risks efficiently, directly enabling faster deal cycles and tight R&W insurance timelines.

“Mage offers six core products: Tabular (grid view), Memo (auto-generated), Redline (contract comparison), Questionnaire (AI-generated questions), Schedules (auto-generated), and Capital Markets...”

Mage positions itself as attorney augmentation where AI handles first-pass review while lawyers verify findings and make final judgments. All extractions link back to source text with confidence scores, hedging language filtering, and accept/reject workflows to prevent AI hallucinations (fabricated citations, court cases, clauses) that could create catastrophic M&A risks.

“Mage positions itself as attorney augmentation tool, not replacement: AI handles first-pass review while attorneys verify findings and make judgment calls”

IP due diligence is forensic work to verify ownership and identify encumbrances that could destroy asset value. Mage detects gaps in IP chain of title, contractor assignment gaps, unrecorded transfers, and license assignability issues. Platform surfaces GPL-licensed code, copyleft license risks, and identifies when founders or contractors retain personal IP ownership—any unresolved issues can fatally undermine deals.

“IP due diligence is positioned as 'forensic' work to verify ownership and identify encumbrances that could destroy asset value post-close”

Change of Control is the #1 deal risk in M&A. Users need to identify and track COC provisions across debt, lease, and contract documents to prevent automatic defaults, lease terminations, and missed third-party consent requirements. Mage automatically detects anti-assignment clauses, indirect COC triggers, and flags consent requirements with materiality categorization to distinguish deal-critical from routine consents.

“Change of Control provisions are the #1 deal risk in M&A transactions”

Disclosure Schedules feature catches incomplete or missing disclosures and cross-references against data room, with intelligent linking of diligence findings to correct Purchase Agreement section numbers. Missing cross-references between related disclosures create legal exposure; automated generation prevents both under-disclosure and kitchen-sinking while supporting Section 3.14 IP requirements.

“Disclosure Schedules feature catches incomplete or missing disclosures and cross-references against data room to ensure completeness before closing”

Indemnification provisions (caps, baskets, survival periods, escrow mechanics) are the backbone of post-closing risk allocation. Mage automatically extracts and categorizes provisions including detection of 'double materiality trap' where reps qualified by 'material' AND mini-baskets create two hurdles to recovery. Platform compares proposed terms against market benchmarks (0.5-1% with RWI, 10-20% without) to inform negotiation strategy.

“Double materiality trap: when a rep is qualified by 'material' AND a mini-basket applies, buyer faces two hurdles to recovery”

Mage uses enterprise/private AI models with zero data retention policy to maintain attorney-client privilege and client confidentiality—critical since public AI models can breach privilege and expose sensitive data to training sets. Enterprise-grade encryption (AES-256 at rest, TLS 1.3 in transit) and isolated processing environments protect client documents.

“Using public AI models for client work can breach privilege and theoretically expose sensitive data to become part of model training sets.”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.