What Mod AI users actually want

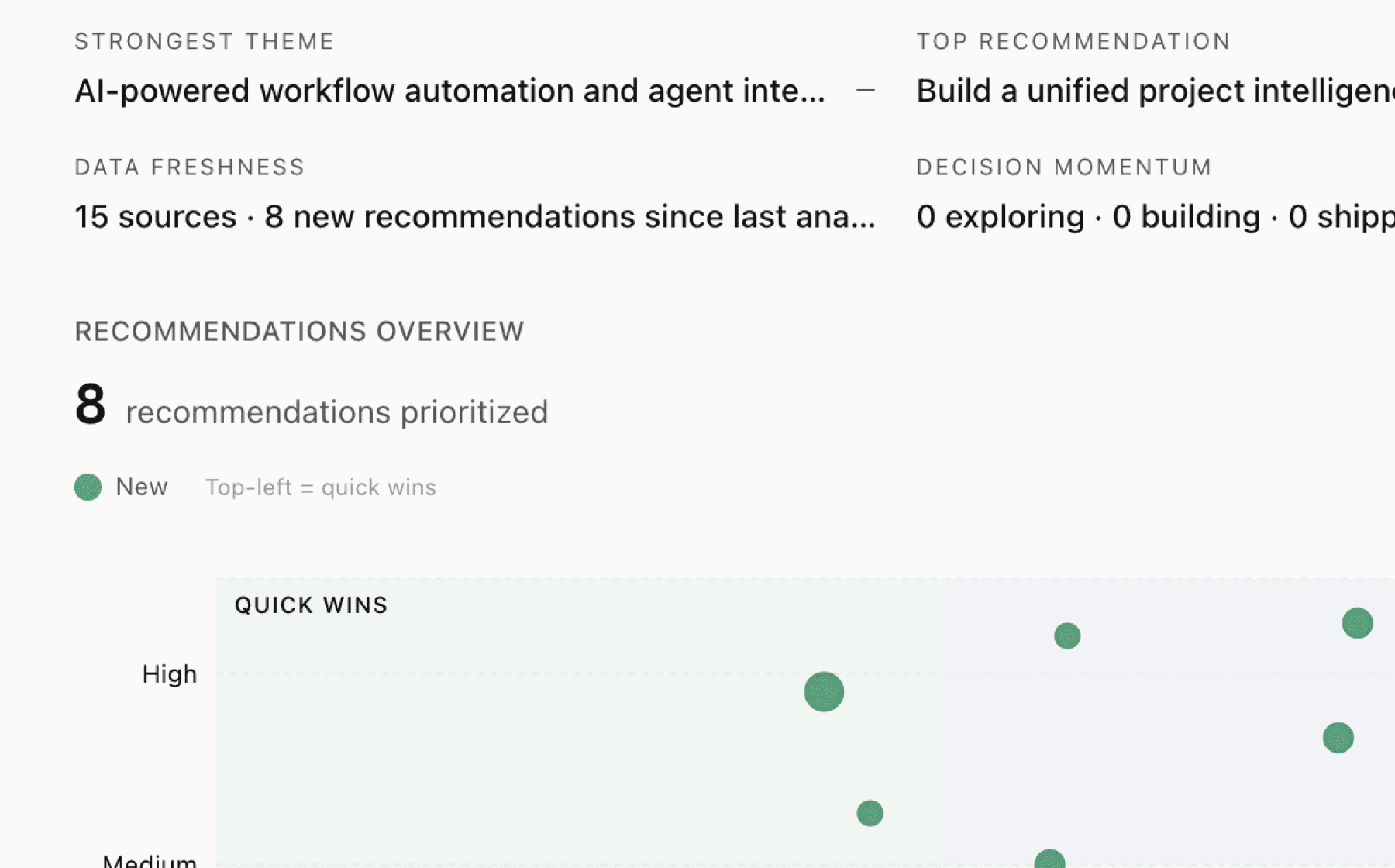

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 15 patterns with 8 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Launch email-based invoice approval with smart escalation and role-based routing

High impact · Medium effort

Rationale

Approval bottlenecks are killing processing speed and directly undermining user engagement. Approvers stuck in meetings, traveling, or ignoring system logins create backlogs that cascade into late payments and month-end chaos. The product already automates the 80% of time spent in email—extending that automation to approval workflows is the logical next step.

Email-based approvals eliminate system login friction and let approvers act from their phone in seconds. Smart escalation and role-based routing remove single-person dependencies that currently paralyze invoice processing when someone is out of office. This change accelerates the core workflow users care about most—getting invoices paid on time—and directly improves the engagement metric by reducing the manual chase-down work that frustrates AP teams daily.

The evidence is clear: users are begging for this. Quotes like 'never chase down an approver again' and examples of invoices piling up behind unavailable approvers show this is a top-of-mind pain point. With 18.2K invoices already flowing through the system and 87% processing time improvements elsewhere, approval friction is now the binding constraint on end-to-end cycle time.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

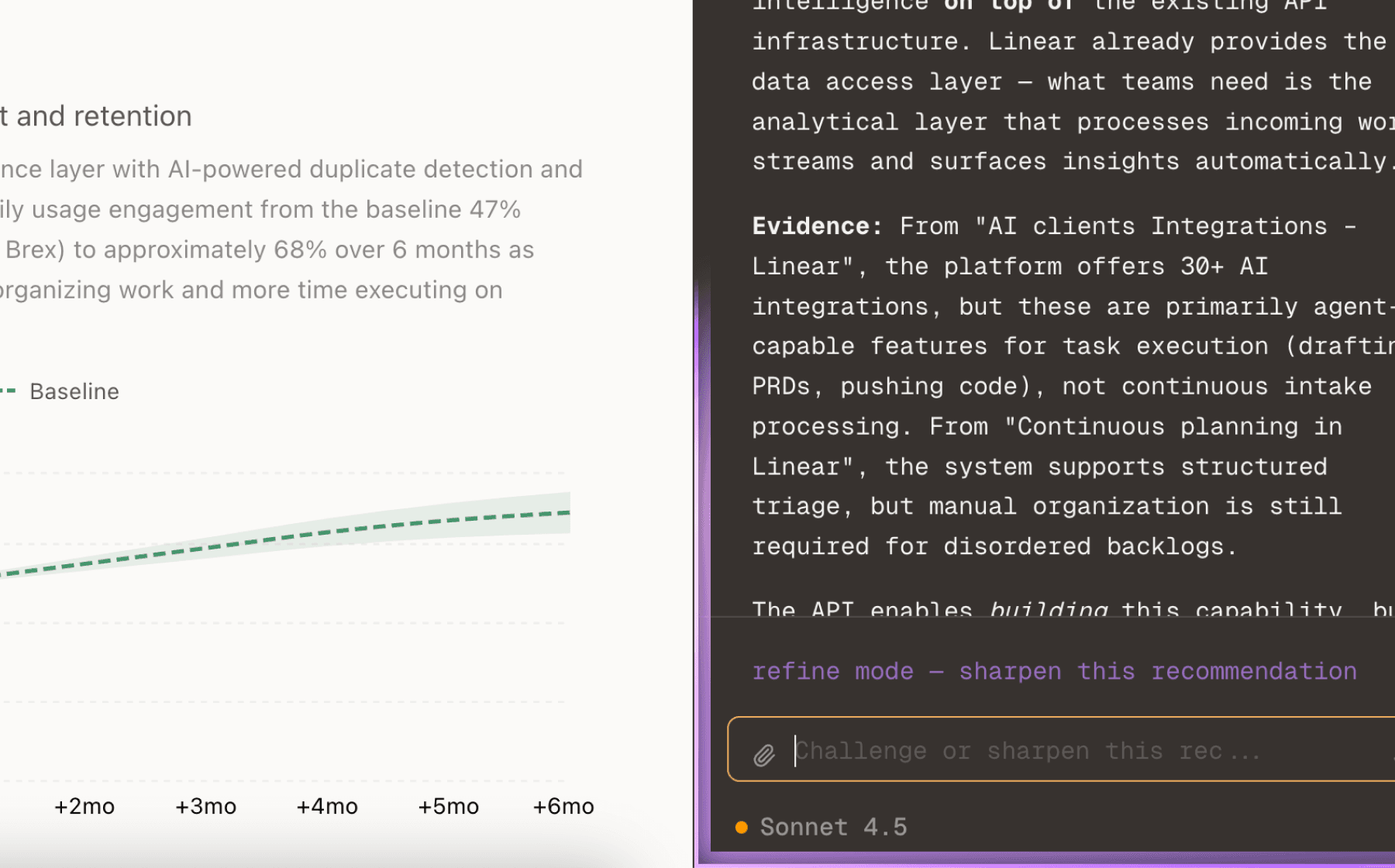

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

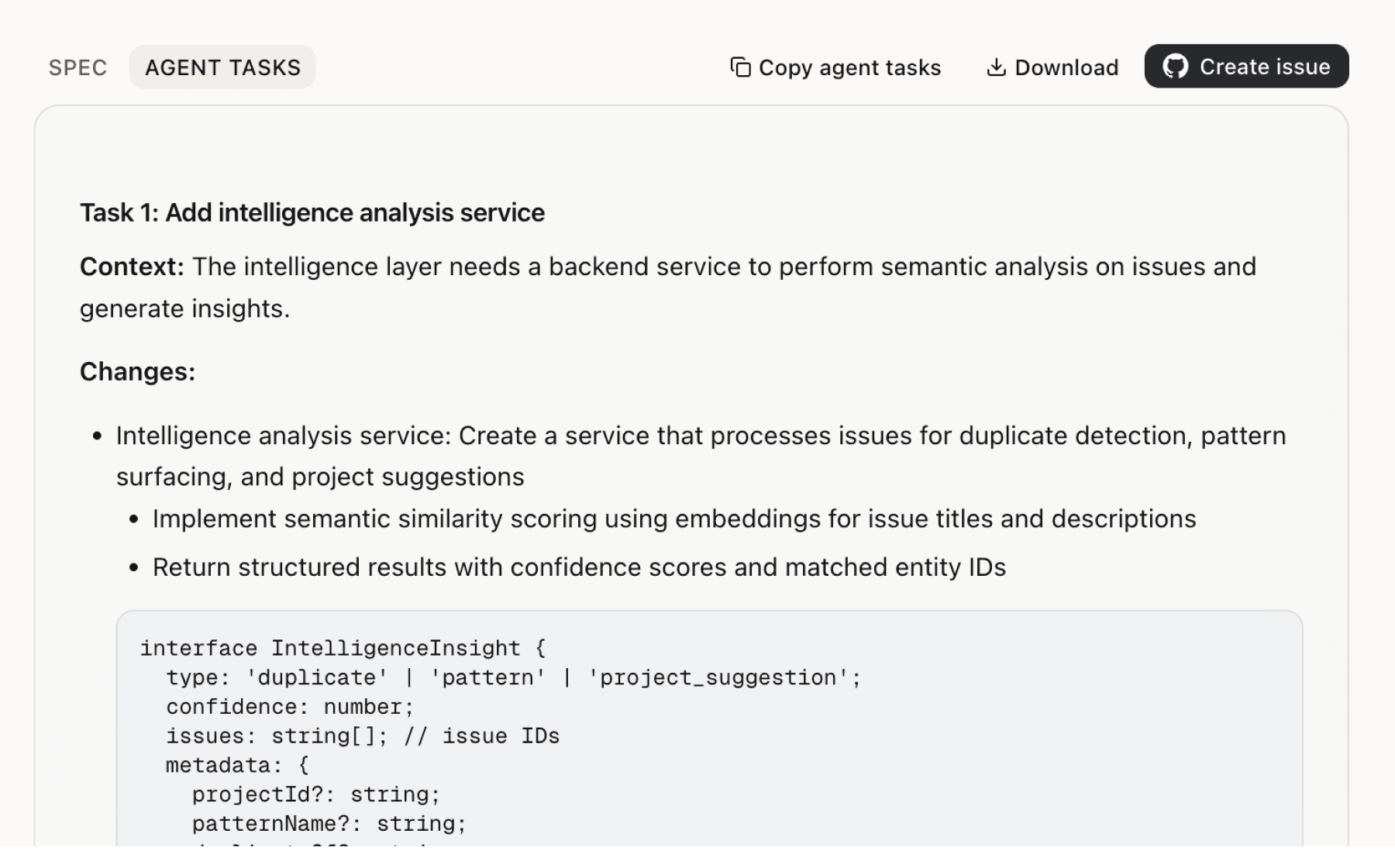

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

7 additional recommendations generated from the same analysis

Payment fraud attempts hit 79% of companies last year, and the stakes are existential—a single missed spoofed domain or bank account change can cost tens of thousands of dollars. Users are already overwhelmed processing high volumes, which means sophisticated fraud indicators like domain spoofing and social engineering slip through. The product has fraud detection capabilities but needs to surface alerts more proactively and give users control over how suspicious activity gets handled.

The product has exceptional engagement signals—customers converted to investors, quotes like 'their demo blew us away,' and implementation described as a 'no brainer.' But the current onboarding likely explains features instead of demonstrating immediate impact. Users evaluating the product need to see their inbox chaos vanish in real-time to viscerally understand the 80% time savings promise.

The product offers a pre-sale ROI calculator with personalized inputs, but once users sign up they lose visibility into whether they're actually achieving those savings. Finance leaders who justified the purchase based on $97.2K savings projections and 3,847 hours saved need proof that the investment is paying off—especially as they consider expansion or renewal.

Vendor setup and year-end W-9 collection are tedious, error-prone processes that fall outside the core invoice-to-pay workflow but create significant friction. Users spend days collecting documents, manually entering data, and chasing approvals for each new vendor. The Vendor Updates Agent can already extract tax IDs, bank details, and addresses, but the full end-to-end workflow—from document receipt through ERP entry—isn't fully automated.

The product supports 12+ ERP platforms with two-way sync, but enterprise customers on SAP, Oracle, and Workday expect near real-time data flow and custom field mapping for complex environments. Daily sync is fine for small teams, but larger organizations processing thousands of invoices need faster refresh rates to keep AI agents accurate and up-to-date.

The product flags duplicate invoices, bank account mismatches, and altered documents, but every organization has unique patterns that signal trouble. A construction company might care about unusual material cost spikes, while a software company focuses on subscription billing anomalies. Right now, anomaly detection uses generic rules, which means some teams get too many false positives while others miss critical issues.

The product maintains 18+ competitor comparison pages and positions against legacy AP automation, email tools, spend management platforms, and document processing vendors. This suggests competitive pressure is real and customers are actively evaluating alternatives. But static comparison pages go stale quickly, and sales teams need current intelligence to handle objections and win deals against entrenched incumbents.

Insights

Themes and patterns synthesized from customer feedback

Founding team with AI expertise from LinkedIn, Amazon, and Adyen, combined with Fortune 500 advisors including former CEOs of acquired AP platforms, establishes credibility and trust. Customer-to-investor conversion indicates exceptional product-market fit and engagement.

“We felt a great connection right away with the Mod AI team, and their demo blew us away.”

Legacy AP automation has failed to solve core workflow problems despite decades of existence, leaving teams overwhelmed at month-end. Mod AI's modern AI-agent approach, validated by Y Combinator and accounting leaders, fundamentally transforms AP operations and represents a discontinuous improvement over existing solutions.

“Most companies are still only scratching the surface of AP automation potential despite transformation in how finance teams operate”

Multi-inbox support (Outlook, Gmail, AP-specific inboxes) with email classification enables seamless integration into existing communication infrastructure without forcing tool switching. This reduces adoption friction and accelerates user onboarding.

“Product connects to major email providers (Outlook, Gmail) and AP-specific inboxes for flexible integration”

Blog content on AP automation ROI, fraud prevention, legacy system shortcomings, and modern practices positions Mod AI as an authority. This helps prospects understand the strategic value of AP automation and reduces perceived risk in adoption decisions.

“Blog content heavily focused on AP automation education (ROI, fraud prevention, legacy system shortcomings, modern AP practices, vendor payment timing)”

Finance leaders need personalized ROI calculations by company size, invoice volume, and team size to justify adoption. Demonstrated metrics (41% cost reduction, $97.2K in savings, 3,847 hours saved monthly) and transparent pricing with flexible credit models reduce adoption friction and allow teams to scale without over-committing.

“Cost savings increased by 41%”

Deep support for 12+ ERP platforms (SAP, Oracle, Workday, Microsoft Dynamics) with two-way sync of vendor, PO, and accounting data ensures the product works seamlessly within existing finance stacks. Real-time data context enables AI agents to assist across chat, vendor emails, and invoice processing without user friction.

“Supports integrations with 14 major accounting platforms including QuickBooks, NetSuite, Xero, Dynamics 365, Oracle Cloud, Workday, and Sage Intacct”

Manual vendor onboarding is error-prone, duplicate invoices slip through, and bulk W-9 processing lacks discrepancy detection. High-confidence AI extraction with line-item anomaly detection and automated verification of vendor details (tax IDs, bank accounts, addresses) ensures data integrity and compliance.

“New vendor setup is time-consuming and error-prone, requiring document collection, manual data entry, approvals, and ERP updates across multiple systems”

Year-end W-9 collection and vendor onboarding involve tedious manual data entry, spreadsheets, and email chains. End-to-end automation from document receipt through ERP entry eliminates this friction and reduces administrative burden.

“Year-end W-9 collection from dozens of vendors involves spreadsheets, email chains, and tedious manual data entry”

All vendor record changes and approval requests require permission-based workflows with comprehensive audit trails before ERP updates. This prevents unauthorized modifications and ensures compliance with financial controls and governance requirements.

“Permission-based approval workflows for all vendor record changes before ERP updates”

AP teams struggle with uneven workload distribution and lack mechanisms to assign work based on capacity and expertise. Intelligent assignment considering role, availability, and skill level ensures fair task distribution and improves overall team efficiency.

“Uneven workload distribution across team members with no easy mechanism to balance email assignment based on capacity and expertise”

AP clerks spend 80% of their time in email managing vendor communications, payment inquiries, and invoice follow-up across multiple inboxes. The product's email automation capabilities—intelligent triage, response generation, and vendor communication handling—directly address this core pain point and drive user engagement by reclaiming time for strategic work.

“Procurement teams and executives repeatedly request invoice and vendor status updates, requiring manual system digging”

Fraudsters exploit urgency and use subtle domain spoofing and social engineering tactics that humans miss at high processing volumes. Real-time email authentication, pattern detection, and behavior anomaly flagging provide essential protection against financial losses and build user confidence in vendor interactions.

“ERP cross-reference capability to flag bank account changes, address mismatches, new contacts, and vendor master discrepancies”

Out-of-office approvers, single-person dependencies, and system login requirements create invoice processing delays and backlogs. Email-based approvals with role-based assignment and intelligent routing eliminate bottlenecks, accelerate month-end closes, and directly improve the user's primary engagement metric.

“Out-of-office approvers create bottlenecks where invoices pile up and no one else can act on them”

AI agents reduce processing time across vendor onboarding (days to minutes), invoice processing (42 seconds average), and email triage, with 87% improvement in processing time and 18.2K invoices handled. This speed directly improves user engagement by reducing manual work and accelerating month-end operations.

“Vendor onboarding currently takes days; the Vendor Updates Agent reduces this to minutes”

Finance teams require the ability to define complex approval routing and workflows (by amount, department, vendor type) without IT involvement or technical configuration. Plain-English setup reduces friction for non-technical AP staff and accelerates time-to-value.

“Complex routing rules based on amount, department, vendor, and expense type are impossible to manage manually at scale”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.