What Verata users actually want

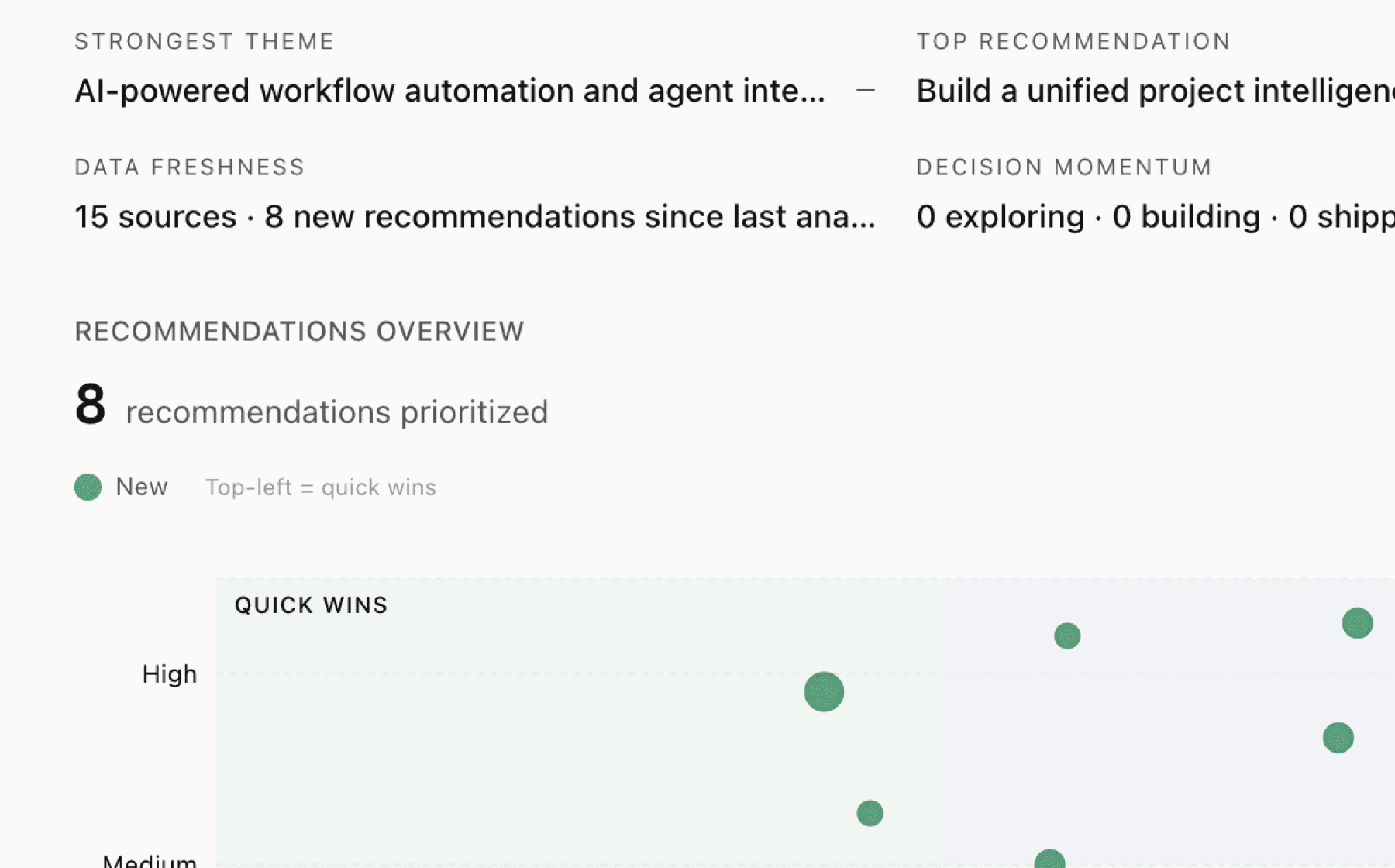

Mimir analyzed 15 public sources — app reviews, Reddit threads, forum posts — and surfaced 14 patterns with 7 actionable recommendations.

This is a preview. Mimir does this with your customer interviews, support tickets, and analytics in under 60 seconds.

Top recommendation

AI-generated, ranked by impact and evidence strength

Build a relationship path discovery engine that surfaces warm introductions to deal targets within 30 seconds

High impact · Large effort

Rationale

This addresses the core value proposition validated across 61 sources. PE firms have valuable networks scattered across partners, principals, and alumni but no systematic way to discover and activate these connections. Manual LinkedIn searching takes 30+ minutes per target and relies on chance encounters. The evidence shows measurable impact: firms report 40% increases in proprietary deal flow, 2-3x higher meeting conversion rates, and $50M+ in facilitated revenue.

The recommendation goes beyond simple network mapping to emphasize speed and actionability. Users need instant answers to "Do we know anyone at this company?" not a research project. Prioritize 1st/2nd/3rd degree connection visualization with shared context (same firm, school, board) and enable one-click identification of optimal introduction paths. This capability differentiates from LinkedIn and PitchBook by mapping fiduciary connections rather than weak social links.

Success metrics include time to find connections (target: under 30 seconds), number of warm introductions facilitated per month, and conversion rate of introductions to meetings. This is the highest-impact feature because it directly enables proprietary deal sourcing, which drives better valuations, higher close rates, and competitive advantage in fundraising and portfolio support.

Projected impact

The full product behind this analysis

Mimir doesn't just analyze — it's a complete product management workflow from feedback to shipped feature.

Evidence-backed insights

Every insight traces back to real customer signals. No hunches, no guesses.

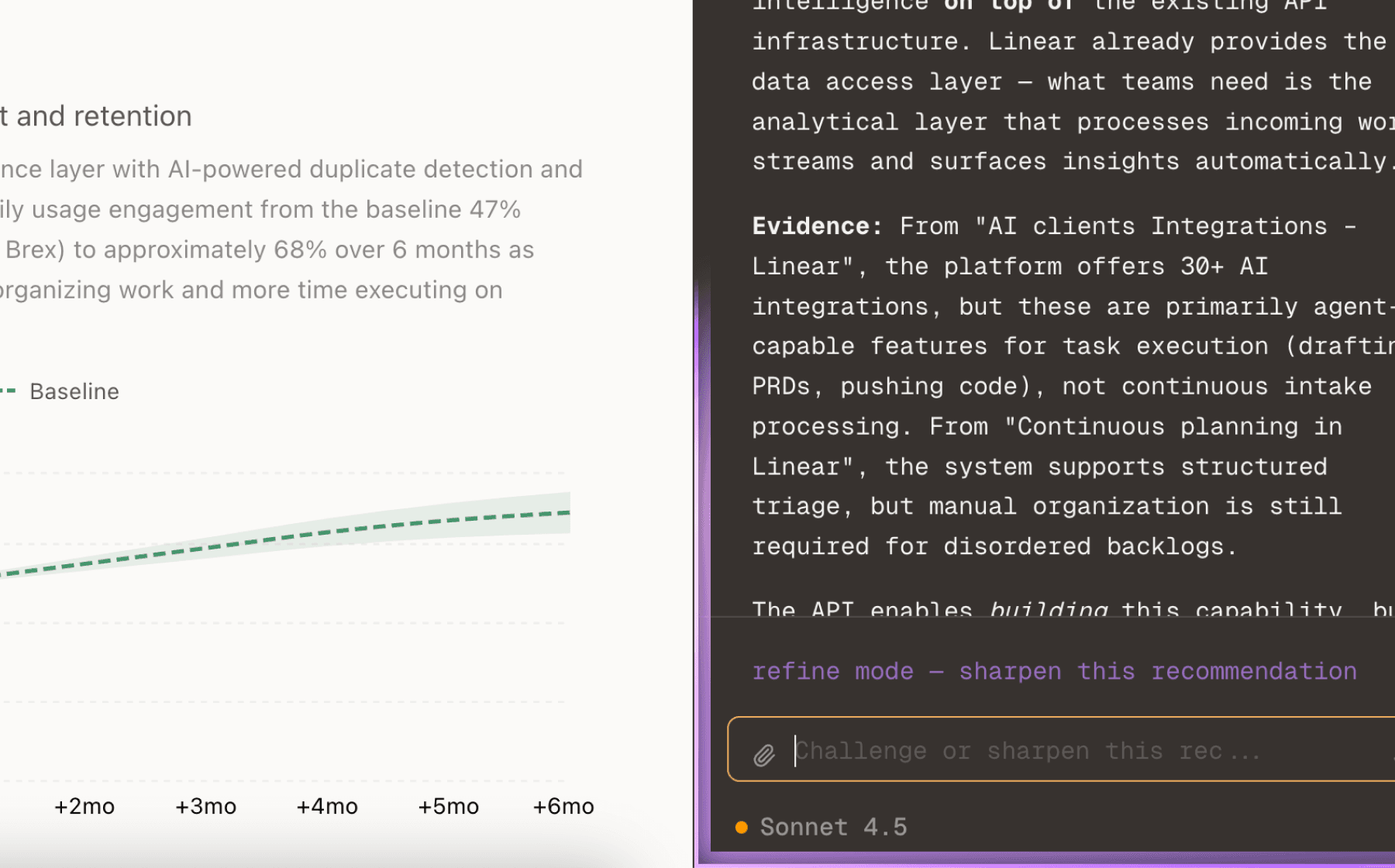

Chat with your data

Ask follow-up questions, refine recommendations, and capture business context through natural conversation.

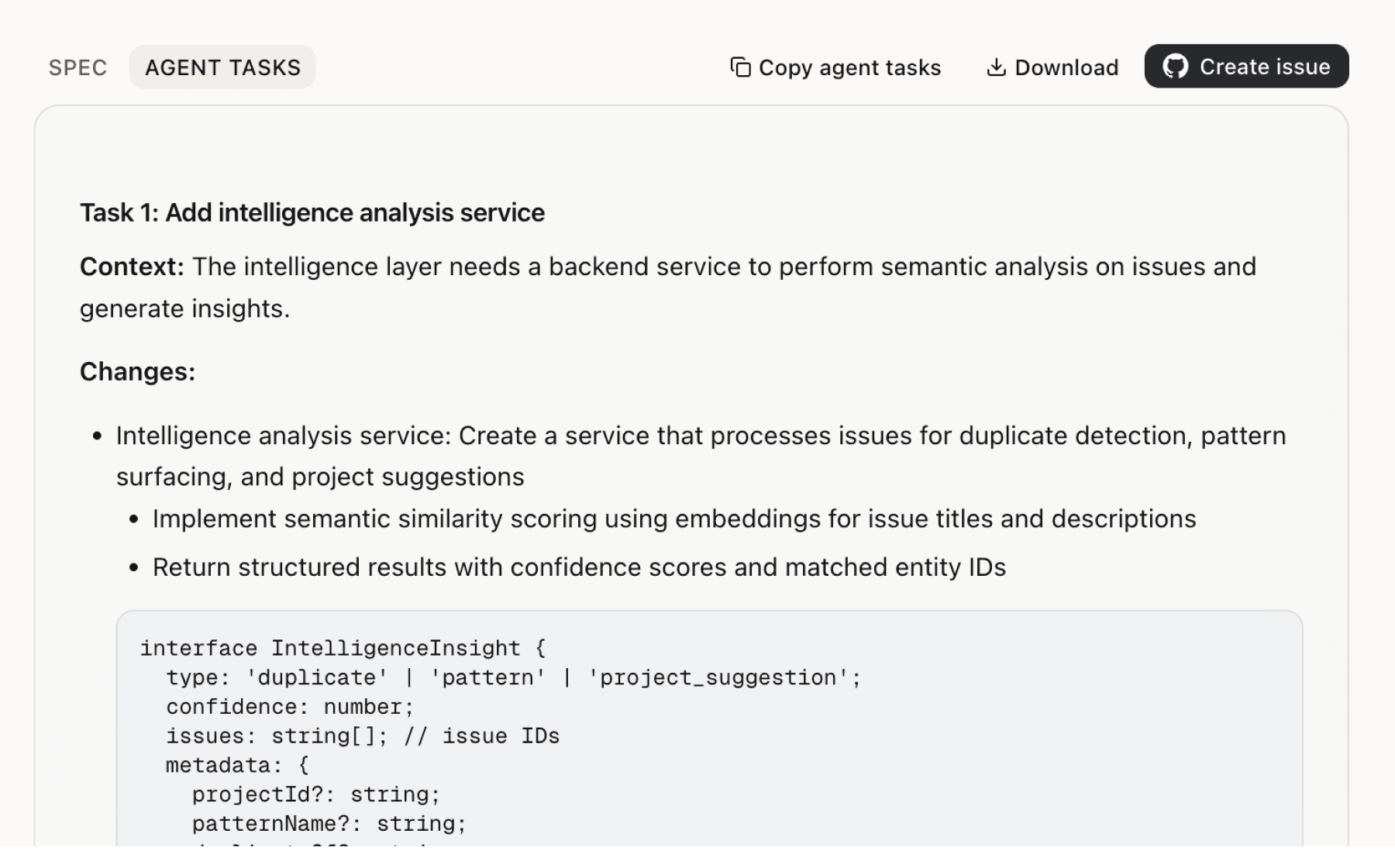

Specs your agents can ship

Go from insight to implementation spec to code-ready tasks in one click.

This analysis used public data only. Imagine what Mimir finds with your customer interviews and product analytics.

Try with your dataMore recommendations

6 additional recommendations generated from the same analysis

Deal team members spend 45-60 minutes toggling between five different sources to screen a single inbound opportunity. This research bottleneck prevents senior staff from engaging in strategic work and buries associates in repetitive tasks. The data shows users can reduce screening time by 90% (from 45-60 minutes to 5 minutes) when company intelligence is consolidated.

PE firms rely on search firm recommendations and candidate-provided references without independent verification. This creates expensive hiring mistakes and missed red flags. The evidence shows firms discovered backchannels that prevented "very expensive hiring mistakes" and found 3x more references than previous methods.

Enterprise software adoption fails when time-to-value is slow. The evidence shows trial onboarding designed to deliver value within 24 hours drives conversion, with users stating "I was skeptical, but the trial convinced me." Firms achieve ROI within 2 months and most discover actionable paths within the first week.

Fundraising success depends on warm relationships, but IR teams lack visibility into existing connections to prospective LPs. The data shows firms using Verata report 2-3x higher meeting conversion rates and 40% more qualified LP meetings. One firm accelerated their fundraise timeline by 3-6 months and closed 4 months faster than their previous fund.

Portfolio CEOs frequently ask for help getting meetings with target customers and identifying add-on acquisitions, but finding paths is ad hoc without network visibility. The evidence shows firms sourced 3 add-on acquisitions in year one (all proprietary at better multiples), facilitated $50M+ in portfolio company revenue through customer introductions, and achieved 20-point NPS improvements from systematic network activation.

Managing partners cannot answer critical questions like "Where are our relationship coverage gaps?" or "Are we leveraging collective networks effectively?" This results in duplicate outreach, siloed contact lists, and missed strategic opportunities. The evidence shows lack of coordination causes teams to step on each other and firms cannot systematically assign relationship development targets.

Insights

Themes and patterns synthesized from customer feedback

Superior deal sourcing requires mapping fiduciary connections (board seats, co-investments, executive overlaps) and layering capital attribution data, which differentiates from generic LinkedIn or PitchBook databases. This relationship intelligence depth provides competitive advantage in sourcing quality and speed.

“Private Company Intelligence: Revenue estimates, headcount, funding history, and leadership profiles”

Enterprise buyers require data protection assurance and operational compatibility with existing workflows. Verata addresses this through SOC 2 Type II compliance, AES-256 encryption in transit and at rest, transparent security practices, straightforward subscription pricing with no surprise invoices, and clear data deletion practices.

“Deal team spends less time on research and more time on relationships; most firms see significant productivity gains within first month”

Effective tool adoption requires teams to collectively experience the product and collaborate on relationship mapping across the firm. Verata's trial design facilitates team-wide engagement and shared understanding of network-based sourcing strategies, accelerating adoption velocity.

“Team members can be added during trial to experience platform collectively”

Reactive sourcing misses opportunities to systematically build relationships with targets matching investment thesis criteria. Verata enables saved search alerts that notify teams when new targets meet investment criteria, supporting proactive and systematic relationship development.

“Saved searches alert users when new targets match investment thesis, enabling systematic relationship development.”

Deal team members spend 30-60 minutes per target screening and 2-3 hours on reference finding, blocking time for higher-value analysis and sourcing. Verata consolidates company intelligence, relationship paths, and financial data into a single searchable platform, dramatically reducing prep time and freeing senior staff for strategic work.

“Sourcing teams spend significant time piecing together information from five different sources to answer basic questions about targets and networks”

PE firms rely on search firm recommendations and self-reported candidate profiles without independent verification of quality or capital outcomes. Verata enables backchannel verification through the firm's own network, identifying high-potential talent likely to exit and triangulating feedback on candidates without relying solely on curated references.

“Verata connects executive talent to capital outcomes by mapping candidate tenures onto transaction timelines and financial events”

Fundraising success depends on warm relationships with LPs, but IR teams lack visibility into existing connections to prospective institutional investors and family offices. Verata reveals hidden relationship bridges through portfolio company CEOs and other existing connections, enabling 2-3x higher meeting conversion rates and accelerating capital raises.

“IR teams cannot see existing relationships their firm already has with target LPs”

Enterprise adoption requires fast deployment and immediate value demonstration to justify tool selection. Verata delivers value within 24 hours of trial onboarding, achieves ROI within 2 months, integrates seamlessly with existing CRM systems (DealCloud, Salesforce, Affinity), and provides 2-day implementation with dedicated onboarding support.

“Trial onboarding process designed to deliver value within 24 hours: account creation, team roster sharing, and sourcing capability”

Portfolio companies need access to their PE firm's hidden networks of executives, operators, and advisors to source customers, partnerships, and add-on acquisitions, but these networks lack visibility. Verata enables systematic activation of firm networks for add-on sourcing, customer introductions, and board placements, driving measurable value creation.

“Portfolio CEOs frequently ask for help getting meetings with target customers, but finding paths is ad hoc without network visibility”

Deal team research is inefficient because private company data is scattered across LinkedIn, databases, and spreadsheets. Verata centralizes proprietary company intelligence including revenue estimates, headcount trends, funding history, and leadership profiles in one searchable platform with depth exceeding PitchBook.

“Research private companies with revenue estimates and leadership profiles”

Deal teams lack visibility into their relationship coverage across sectors and geographies, making market mapping slow and manual. Verata enables automated construction of comprehensive sector maps in hours and visualizes relationship gaps to identify strategic coverage priorities.

“Build comprehensive sector maps in minutes”

PE firms struggle to measure which relationship-building activities generate deals and track sourcing attribution to specific relationships. Verata provides pipeline visibility that shows relationship paths alongside deal stages, enabling firms to quantify ROI and identify which relationships drive which opportunities.

“Difficulty measuring which relationship-building activities actually generate deals and attributing sourcing to specific relationships”

PE firms have valuable relationship networks scattered across partners, principals, and alumni but lack systems to systematically discover and activate warm paths to deal targets. Verata maps these hidden connections, enabling deal teams to source proprietary deals with better terms, higher close rates, and measurable outcomes ($50M+ facilitated revenue, 40% deal flow increases, 2-3x meeting conversion improvements).

“PE firms have thousands of relationships scattered across partners, principals, alumni, and advisors, but this relationship capital is locked in people's heads and LinkedIn profiles with no...”

Managing partners and deal leads cannot see where relationship coverage exists across the firm, resulting in duplicate outreach, siloed contact lists, and missed strategic opportunities. Verata provides systematic visibility into firm-wide relationship assets and identifies coverage gaps by sector and geography, enabling coordinated outreach and strategic relationship development.

“Lack of coordination on relationship development—teams duplicate outreach efforts and step on each other”

Run this analysis on your own data

Upload feedback, interviews, or metrics. Get results like these in under 60 seconds.